Tapered annual allowance – threshold and adjusted income

So what is the tapered annual allowance?

Pension annual allowance (AA) is the annual limit on the amount of contributions paid to, or benefits accrued in, a pension scheme before the member has to pay tax.

Tapered annual allowance is lower than the standard annual allowance. This lower limit may apply to any member, based on their level of taxable income within the tax year.

Key points

The tapered annual allowance was introduced from 6th April 2016.

For the taper to apply, the limits on threshold income and adjusted income must both be exceeded.

For every £2 of adjusted income over £150,000, an individual’s annual allowance is reduced by £1.

Why was the tapered annual allowance introduced

The government, in an attempt to control the cost of pensions tax relief and help make sure pensions tax relief is fair and affordable. So from tax year 2016/17, a reduced annual allowance may apply to all pension savings by or on behalf of a member, depending on their level of taxable income within the tax year.

On 6 April 2016 the government introduced the Tapered Annual Allowance for individuals with “threshold income” of over £110,000 AND "adjusted income" of over £150,000.

So what is threshold income?

Threshold income is one of two measures used to determine if a member has a tapered annual allowance limit.

Where an individual has a "threshold income" of £110,000 or less they cannot be subject to the tapered annual allowance and there is no requirement to calculate adjusted income. If threshold income exceeds £110,000 there must be a calculation on the adjusted income to work out the amount of any tapered annual allowance.

For individuals with lower salaries who may have one off spikes in their employer pension contributions the threshold income measure helps to provide certainty . If the individual’s taxable net income is no more than £110,000 they will not normally be subject to the tapered annual allowance. Anti-avoidance rules will apply so that any salary sacrifice for pension savings set up on or after 9 July 2015 will be included in the threshold income calculation.

"Threshold Income" is broadly defined as ‘the individual’s net income for the year’. This will include all taxable income such as salary, bonus, pension income (including state pension), taxable element of redundancy payments, taxable social security payments, trading profits, income from property (rental income), dividend income, onshore and offshore bond gains, taxable payment from a Purchased Life Annuity, interest from savings accounts held with banks, building societies, NS&I and Credit Unions, interest distributions from authorised unit trusts and open-ended investment companies, profit on government or company bonds which are issued at a discount or repayable at a premium and income from certain alternative finance arrangements etc, less the amount of any taxable lump sum pension death benefits paid to the individual during the tax year that can be deducted from the threshold income.

What is adjusted income?

Adjusted income is the other of alternative measure used to determine if a member has a tapered annual allowance limit.

The ‘adjusted income’ definition adds in all employer pension contributions, to prevent individuals from avoiding the restriction by exchanging salary for employer contributions. For those in defined benefit or cash balance arrangements, the value of the employer contribution will be calculated using the annual allowance methodology. That is, the employer contribution will be the total pension input amount for the arrangement, less the monetary amount of any contributions made.

How does the taper work

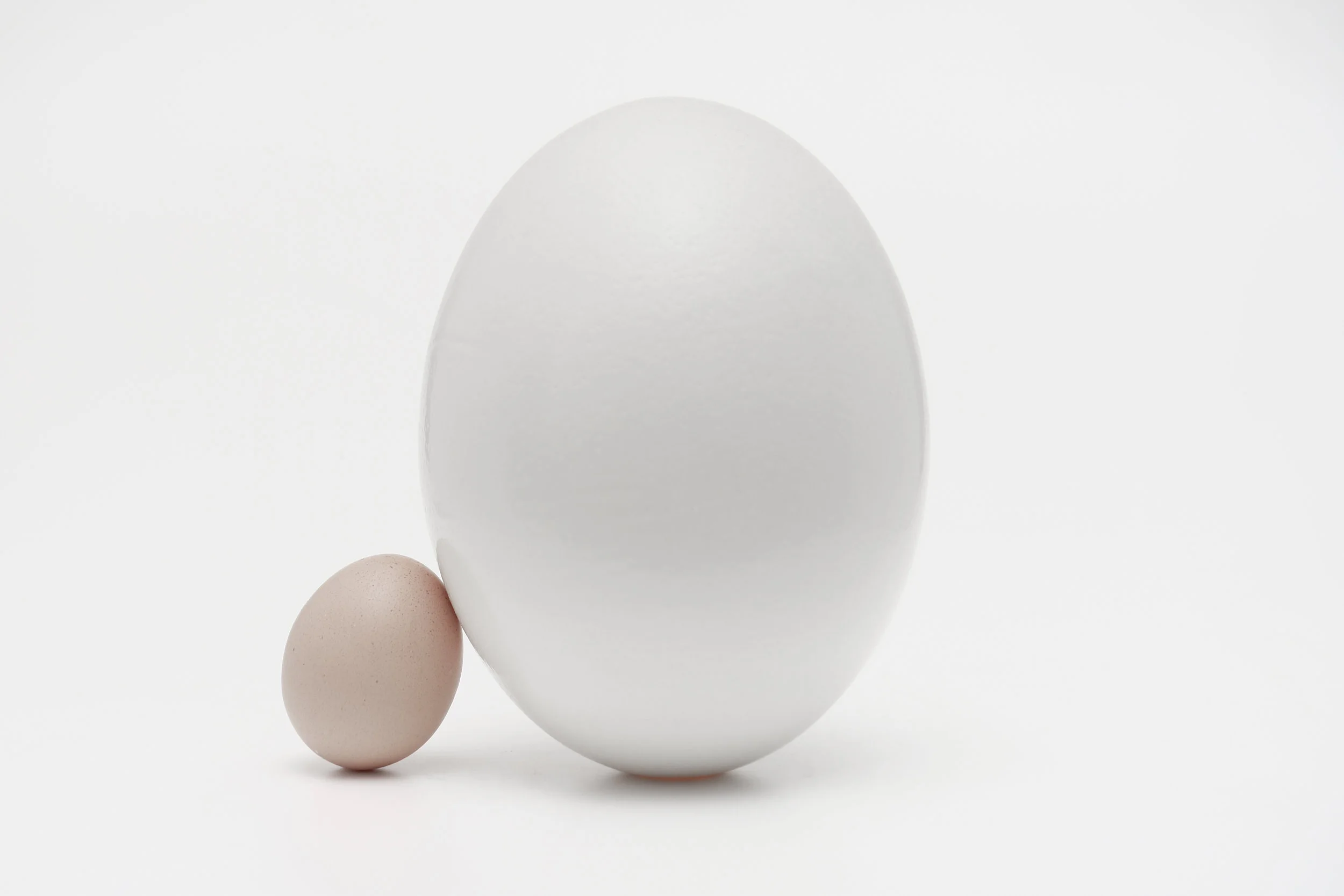

Where both the adjusted income and threshold income have been exceeded then the rate of reduction in the annual allowance is by £1 for every £2 that the adjusted income exceeds £150,000, up to a maximum reduction of £30,000, down to a minimum tapered annual allowance of £10,000.

This results in an Annual Allowance of £40,000 for those with an adjusted income of less than £150,000; a reducing Annual Allowance for those with adjusted incomes between £150,000 and £210,000 and an Annual Allowance of £10,000 for those with an adjusted income over £210,000.

The Tapered Annual Allowance limits apply to both Defined Contribution and Defined Benefit pension input amounts. Although the value of "contributions" is easily identifiable within Defined Contribution type schemes, it is not as straightforward with Defined Benefit schemes. When assessing against the above limits it is the combined total of all pension "contributions" that need to be considered. In some circumstances deferred pensions may also count towards the calculation of "contributions".

Those subject to a Tapered Annual Allowance will still be able to carry forward unused allowance from previous tax years.

Source: Prudential