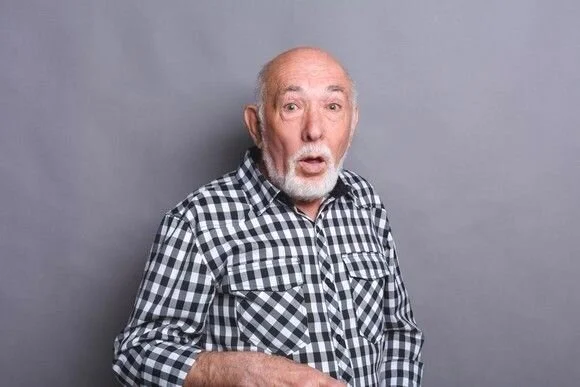

The potential shock awaiting retirees

A study in April 2109 shows there could be an unwelcome surprise for those who save too little, too late.

How much income do you think you’ll need in retirement? *1

Research shows that UK investors expect to need an income equal to two-thirds of their current salary to afford to live comfortably. Yet, the average amount received by today’s retirees is far less, at 53% of final salary.

This gap spells disappointment for those individuals and couples who do not have the funds to support the lifestyle they would like in retirement. It also raises the rather difficult question of how much of our salary we should be putting away to maintain our lifestyles after we stop working.

According to research by Schroders, a 25-year-old who would like to retire on a two-thirds pension at 65 should be tucking away 15% of their salary each year.

At that savings rate, an average annual return of 2.5% above inflation would create a pot large enough to produce a retirement income to meet their target.

But if that person was to save 10% of their salary, the annual return they’d need would shoot up to 4.2% over inflation.

If they were to save only 5% of their salary (the current overall minimum contribution rate for auto-enrolment), they may need returns that exceed inflation by 7%.

Unfortunately, history is not on the side of investors relying on achieving that rate of return over the medium to long term.

The Schroders research revealed general acknowledgement by non-retired people that they need to be saving more to achieve the standard of living they want in retirement. The difference between what they are saving, and what think they should be saving, was the biggest amongst Generation X – individuals aged between 37 and 50 – indicating perhaps a growing concern that they are at risk of leaving it too late.

“To have the best chance of a comfortable retirement, the lesson for younger workers is to start saving early,” says Lesley-Ann Morgan, Head of Retirement at Schroders. “Leaving retirement saving until you are nearing your 50s and 60s is likely to be too late to make up the savings gap.”

It’s about time

Some experts suggest that if you leave retirement saving until age 40, then you’ll need to put away at least 20% of your income – and that you should maintain this percentage as your earnings increase.

If that's a tall order, there might be other opportunities to boost your savings rate; for example, a bonus or inheritance could make a big difference to your long-term prospects. So, if you have surplus cash that is not earmarked for other purposes and you haven’t used all your pension allowances, making a one-off pension contribution can be a smart way to get nearer that retirement goal.

Time is your biggest ally when it comes to saving, thanks to the power of compounding. But that doesn’t mean there aren’t significant opportunities to catch up, and the end of the tax year presents an ideal opportunity to do so.

Source: 1 Schroders, Global Investor Study 2018

So what is a good pension pot at 55?

According to Scottish Widows, someone who has left pension saving to their 50s would need to put away £1,445 a month to achieve a £23,000 annual income at retirement.

This estimate was derived using The Telegraph Pensions Calculator, assuming someone earning £30,000 a year, with contributions being supplemented with a 4% employer contribution. The calculations allow for inflation, both in discounting back the final results so they’re in ‘today’s money’ and in assuming that contributions increase with earnings each year.

If you are in your 50s, make sure you check when you’ll start receiving your State Pension. Research by YouGov for the charity Age UK conducted in December 2018 found that one in four people aged between 50 and 64, equivalent to nearly three million people, don’t know what their State Pension age is.

Source: Schroders