Small pots and defined benefit trivial commutations

What is a pension small pot payment?

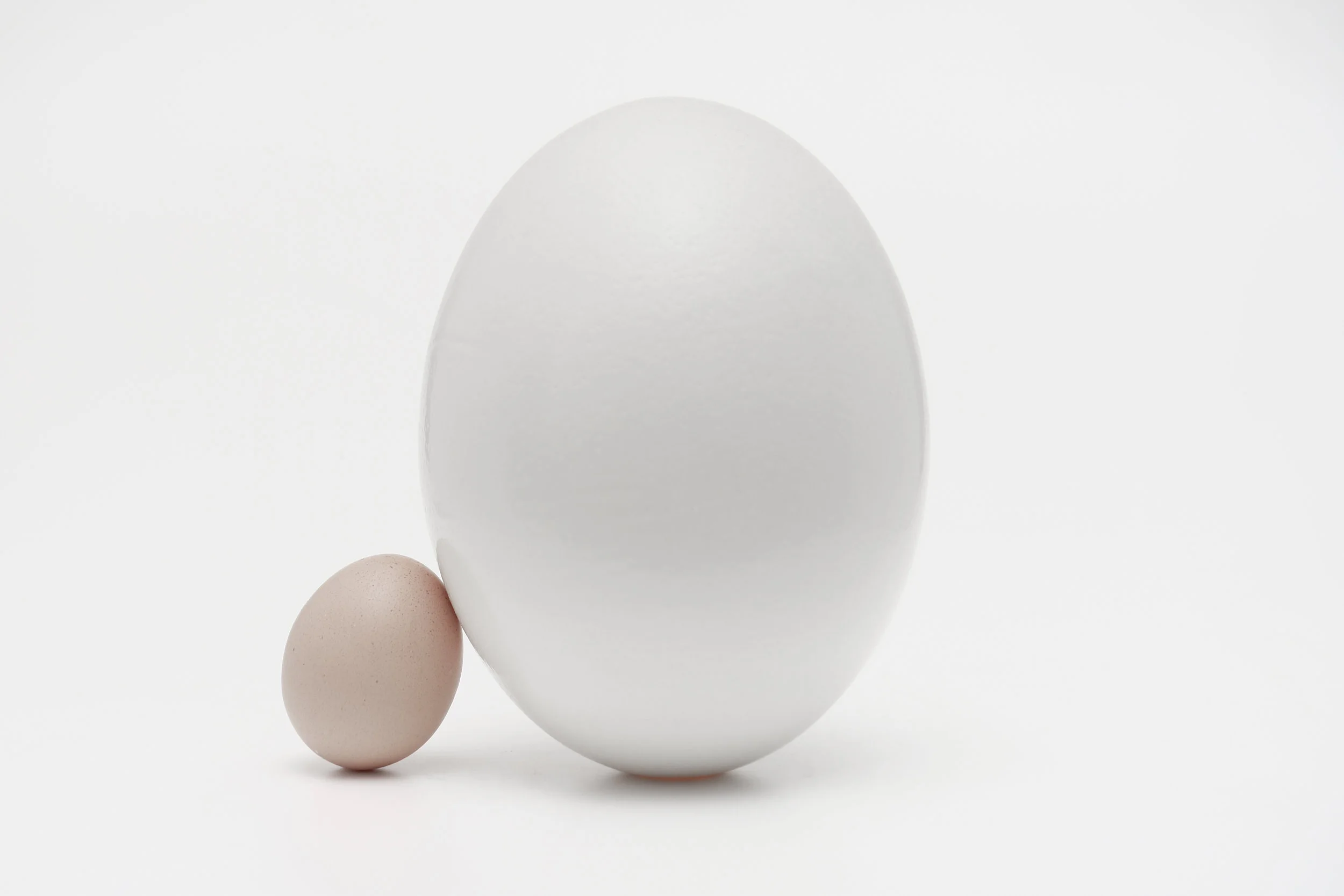

Due the nature of working life many of us move employer several times and as a result we can leave behind small pension pots. If you have small pensions, you may be able to take them as cash lump sums - up to three small pots of £10,000 each from non-occupational pension schemes and an unlimited number from occupational pension schemes, subject to certain rules.

Small pots - so what do you need to know?

A maximum of three small, non-occupational pensions can be commuted under small pot payments.

There is no limit to the number of occupational pensions that can be commuted under small pot rules.

A small pot payment (properly called ‘small lump sum’) can be made from any arrangement, whether the rights are uncrystallised or comprise a pension in payment, irrespective of the overall value of the individual's pension's worth. Up to three small non-occupational pensions (personal pension plans etc.) can be commuted under small pots payments, but there’s no limit on the number of occupational pensions that can be taken under small pots. To allow the payment of small pot commutation, the following conditions need to be fulfilled:

The member has reached the minimum retirement age of 55, or satisfies the definition for ill-health early retirement or has a protected early pension age each payment must not exceed £10,000 at the time it’s paid to the member

For non-occupational pension schemes, the payment must extinguish all member benefit entitlement under the arrangement

For occupational or public service pension schemes, the payment must extinguish the member’s entitlement to benefits under the paying scheme, in respect of non-occupational pensions (personal pensions etc.), there’s a maximum of three small pot payments are permitted. A full list of the conditions is in the Pensions Tax Manual (PTM063700) covering;

Payments under occupational or public service pension schemes

Payments under larger occupational or public service pension schemes

Payments under a scheme that is not an occupational or public service pension scheme

Small pots from non-occupational pension schemes are about arrangements, not schemes

‘Small pots’ applies at arrangement level rather than scheme level. So the payments can be made from two or three separate registered pension schemes or from the same scheme where the payments are made from two or three different arrangements under that scheme.

Effect on entitlement to benefits

Small pot payments extinguish the member’s entitlement to benefits under the arrangement from which the payment is made, but not necessarily their entitlement under the scheme as a whole. A member can take a small lump sum even though they may still have an entitlement to benefits under another arrangement in that scheme.

Managing a large number of arrangements

For example 100 arrangements under the same registered pension scheme, where each arrangement contains well under the commutation limit under this regulation. Subject to what the scheme rules allow, these funds may be consolidated either by merging arrangements into a smaller number of arrangements or by a transfer of funds between multiple arrangements. This allows the maximum small pot to be taken from either one or each of two or three arrangements under the scheme. A ‘reshaping’ of existing arrangements (either by merging multiple arrangements or internal transfers of funds between multiple arrangements in the same scheme) won’t involve the setting up of a new arrangement. This avoids any potential consequences for members who have valid enhanced protection, fixed protection, fixed protection 2014 or fixed protection 2016.

Funds in excess of the commutation limit

If a member has funds in excess of the limit in an existing single arrangement, some of which are then moved into arrangements set up to allow a member to take one, two or three small lump sum payments under Regulation 11A, this will entail the setting up of one or more new arrangements. This could potentially have consequences if the member has valid enhanced protection or any of the fixed protections (i.e. the protection would be lost).

Please note: small pots don’t trigger the money purchase annual allowance (MPAA).

Crystallised and uncrystallised benefit rights

Where the payment represents uncrystallised benefit rights, 25% of the payment is free of income tax, and the balance of the payment is chargeable to income tax as pension income. If the payment represents crystallised rights, all of the payment is chargeable to income tax as pension income. Where the payment represents a mixture of both uncrystallised and crystallised benefit rights, only 25% of the part of the payment relating to the uncrystallised rights can be paid free of income tax.

What is trivial commutation?

Trivial commutation is where a defined benefit pension member may commute one or more pension arrangements as long as they comply with the following:

the member has reached the minimum retirement age of 55, or satisfies the definition for ill-health early retirement or has a protected early pension age

the lump sum extinguishes the member’s entitlement to defined benefits under the registered pension scheme making the payment

all commutations must take place within a 12-month period from the date of the first trivial commutation payment. Any commuted lump sum paid after the 12-month period has ended won’t qualify as a trivial commutation lump sum

the value of all members’ rights should not exceed £30,000 on the nominated date (the nominated date can be any date within 3 months of the start of the commutation period). The £30,000 value is for all pensions, so if a client has a DB scheme valued at £29,000 and a Stakeholder Pension worth £2,000 on the nominated date then commuting the DB scheme will not be possible.

the member hasn’t been paid a trivial commutation lump sum previously (from any registered pension scheme), except any earlier payment within the commutation period (a trivial commutation that occurred before 6 April 2006 doesn’t count)

the lump sum is paid when the member has some available lifetime allowance.

If the member hasn’t previously drawn or become entitled to any other benefits under the registered pension scheme before the trivial commutation lump sum is paid, 75% of the lump sum paid is treated as taxable pension income for the tax year the payment is made, accountable through PAYE. The 25% deduction is given to reflect that, if the trivial commutation lump sum wasn’t paid and normal benefit rules applied, the member would (generally) be entitled to a tax-free pension commencement lump sum, representing 25% of the capital value of the benefits coming into payment. No extra deduction is given where the member is entitled to a pension commencement lump sum of more than 25%, due to the transitional protection of such an entitlement held before 6 April 2006.

Where a pension in payment is being commuted, or the member has previously drawn (or become entitled to) any other benefit from the scheme, but still has uncrystallised rights held in any arrangement under the scheme, 25% of the value of the uncrystallised rights may be paid tax-free. The remaining part of the payment is taxed as pension income for the tax year the lump sum payment is made. Again, this taxable income is accountable through PAYE.

Since April 2015, trivial commutation of all pension benefits has only been relevant to defined benefit pension schemes. Historically, it was also used for defined contribution schemes. However, the introduction of pensions flexibility for DC schemes after April 2015 removed the need for this option, as all DC benefits can now be accessed as lump sum (regardless of the amount).

Commutation of DB lump sum death benefit

If, on the death of a member the capital value of the following pensions is under £30,000 per scheme, a commutation lump sum death benefit can be paid instead of the ongoing pension benefit:

dependant / nominee / joint life pension

guaranteed annuity / scheme pension guarantees.

The commutation lump sum death benefit will be subject to marginal rate income tax in the hands of the recipient.