Pension information: guide to the basic facts.

You might have one or more different types of pension. Understanding which you have is important because it affects the decisions you need to make as you approach retirement.

What type of pension do I have?

Your State Pension choices

Your pension choices if you have a defined benefit pension

Your pension choices if you have a defined contribution pension

What type of pension do I have?

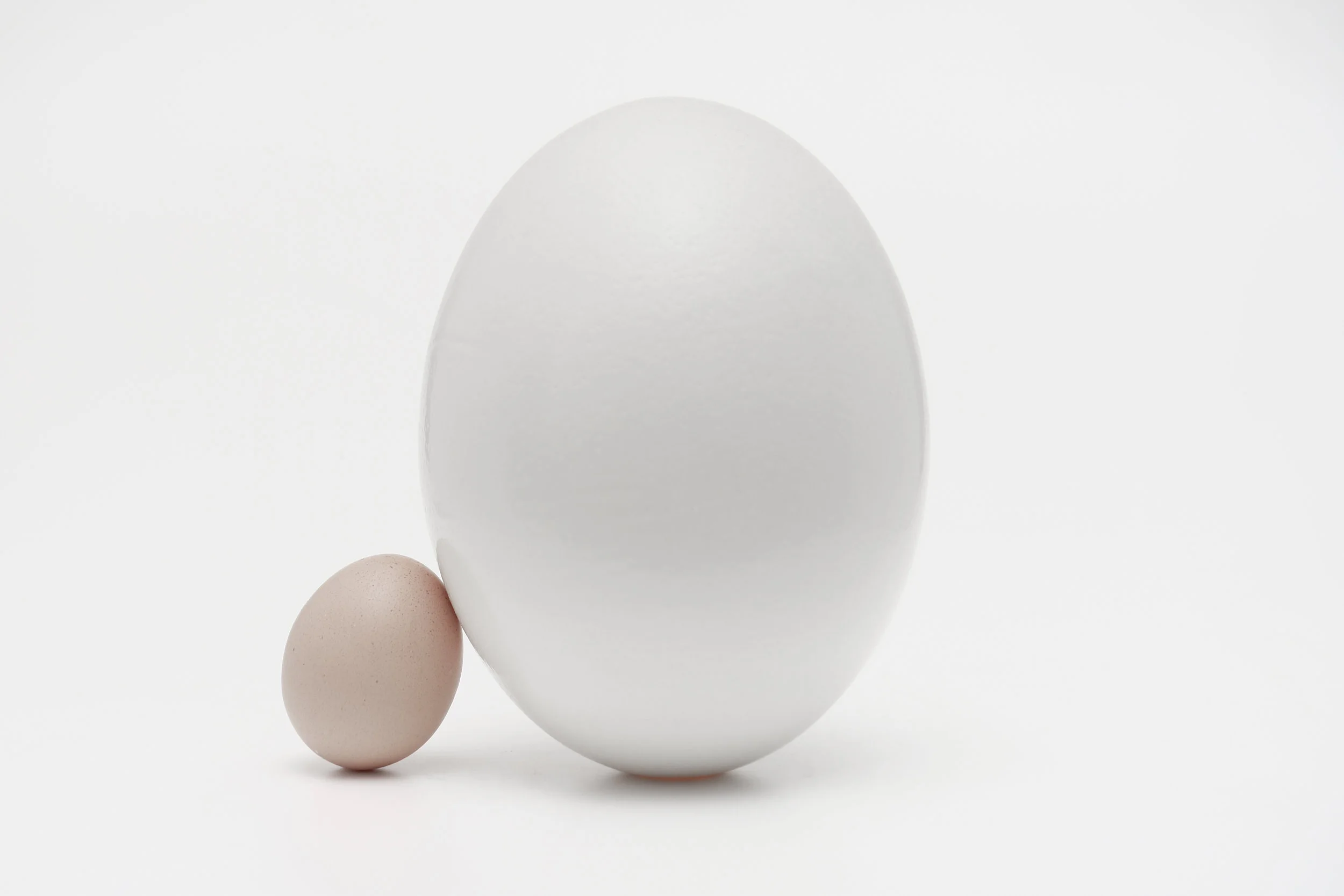

What is a pension pot?

‘Pension pot’ refers to the savings you build up in a certain type of pension known as a ‘defined contribution’ pension scheme. You and your employer (if you are employed) pay into the scheme and this builds up a ‘pot’ of money over time, which you can use to give yourself an income when you want to cut down on how much you work, or stop working altogether. It includes workplace, personal and stakeholder pension schemes.

There are three main types of pension:

the State Pension

defined benefit pensions, and

defined contribution pensions

State Pension

Most people get some State Pension. It’s paid by the government and is a secure income for life which increases by at least the rate of inflation each year.

You build up your entitlement to the State Pension by making National Insurance contributions during your working life.

In some cases, you can do this even when you’re not working, such as when you’re bringing up children or claiming certain benefits.

From April 2016 a new flat-rate State Pension was introduced. For the current tax year 2019-20 the full new State Pension is only £168.60 per week.

However, you might be entitled to more than this if you have built up entitlement to ‘additional state pension’ under the old pre-April 2016 system – or less than this if you were ‘contracted out’ of the additional state pension.

To be eligible for the full State Pension you will need 35 years NI record. You’ll usually need at least 10 qualifying years on your National Insurance record to qualify.

Defined benefit pension

You’re most likely to have a defined benefit (DB) pension if you work in the public sector or for a large company. This is a salary-related pension which pays out a secure income for life and increases each year. The pension you get is based on how long you’ve been a part of the scheme and how much you earn.

You might have a final salary scheme where your pension is based on your pay when you retire or leave the scheme, or alternatively a career-average scheme where your pension is based on the average of your pay while you were a member of the scheme.

Defined contribution pension

With this type of scheme, you build up a pension pot which you can draw an income from when you cut down or stop working. But you must be aged at least 55 before you can start to take money out. With this type of pension scheme, you can usually withdraw at least 25 per cent (a quarter) of your pot tax-free.

The amount that builds up depends on:

the level of charges you pay

how well your investment performs, and

how much you and your employer (if you are employed) pay into the scheme

Defined contribution (DC) pensions include workplace, personal and stakeholder pension schemes.

Your State Pension choices

You won’t get your State Pension automatically – you have to claim it. You should get a letter no later than two months before you reach State Pension age, telling you what to do.

You can also defer taking it. If you want to wait to claim your pension, you don’t need to do anything. Your pension will automatically be deferred until you claim it and will increase by 1% for every nine weeks you defer. This works out at just under 5.8% for every full year.

The extra amount is paid with your regular State Pension payment when you finally take it.

Find out your State Pension age at GOV.UK

Your pension choices if you have a defined benefit pension

Most defined benefit pension schemes have a normal retirement age of 65.

If your scheme allows, you might be able to take your pension earlier but this will reduce the pension you get quite considerably. (Typically 5% per annum)

When you take your pension you usually have the option of taking some of it as a tax-free cash sum.

How much you can take will vary depending on your scheme rules, but often you can take roughly up to a quarter of the value of your pension benefits like this.

Reducing the amount of tax-free cash you take might increase the amount of income you receive.

It is possible to transfer your defined benefit pension to a defined contribution pension which would then allow you to access your pension more flexibly.

However, consider this option very carefully as you might be giving up very valuable benefits.

Before going ahead with a transfer from this type of scheme speak to a regulated financial adviser.

Your pension choices if you have a defined contribution pension

Once you reach 55 you have complete freedom over what to do with your pension pot.

However, the longer you leave your pot to continue building up, the more money you will have to live on in retirement.

To understand the choices for using your pension pot, use could use Pension Wise – the free and impartial service backed by government or if you are still unsure of the best option for you, consider taking regulated financial advice.

Source: pensions advisory service

WINN-BROWN & CO.NOVEMBER 2, 2015